History of the manufacturing industry in Honduras

The maquila in Honduras is not something new. This economic figure has been observed in the national scene for more than three decades, it could even be said that much more, but everything began officially in 1976, with the promulgation of the «Constitutive Law of the Free Zone of Puerto Cortés «According to the archives of the government daily La Gaceta.

Due to its advantageous position as one of the largest ports in Central America, Puerto Cortés was home to the first industrial centers dedicated exclusively to the maquila, the facilities of the «free zone» were filled with large buildings facing the sea. It soon became clear that there was employment there, thousands of women and men began their work here, it was usual to see an army of bicycles in the morning and when the working day ended. People arrived from towns near the port.

From that moment, the flourishing of the maquila, which saw its potential strengthened with the issuance of decrees No. 37-87 of April 1987, which constituted the «Law of Industrial Zones of Export Processing», this benefit was Extended to the municipalities of Amapala, Tela, Choloma, Omoa and La Ceiba, points that propitiated the definitive takeoff of the maquiladora industry in Honduras.

From that moment, the flourishing of the maquila, which saw its potential strengthened with the issuance of decrees No. 37-87 of April 1987, which constituted the «Law of Industrial Zones of Export Processing», this benefit was Extended to the municipalities of Amapala, Tela, Choloma, Omoa and La Ceiba, points that propitiated the definitive takeoff of the maquiladora industry in Honduras.

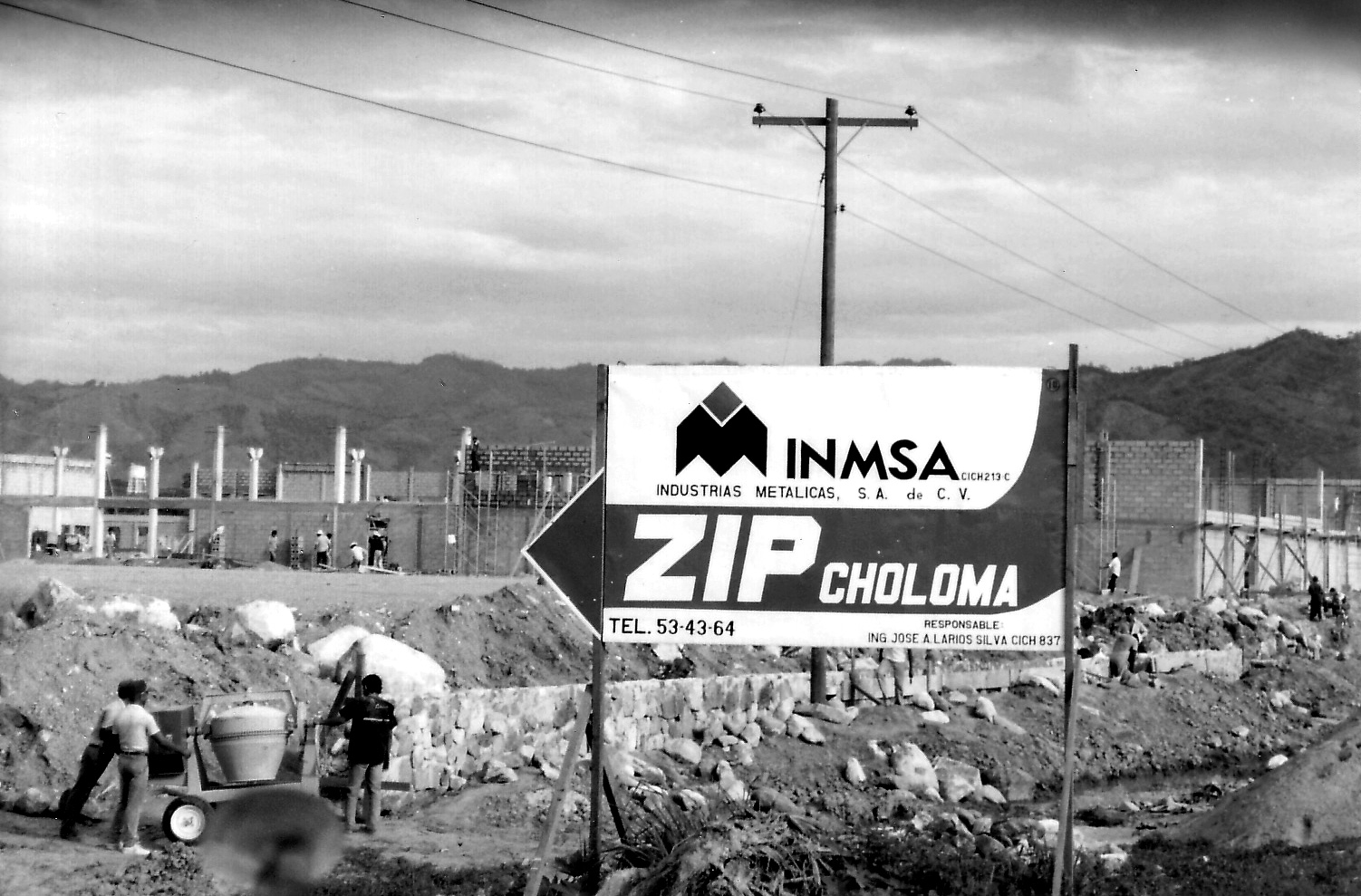

With the inauguration of ZIP Choloma in 1990, the maquila had its culminating moment, from that moment it went up like the foam, new parks appeared, new investors arrived, Choloma became the Mecca of the maquiladoras companies, suddenly, its population grew , Banking offices opened their doors, restaurant businesses, restaurants, cafes and gas stations emerged on both sides of the road leading to Puerto Cortés. The flow of heavy vehicles increased, which is why it was necessary to expand the stretch to become a dual carriageway.

Known as the «martyr city» when it was destroyed by Hurricane Fifi in 1974, Choloma erased its past and reinvented itself as the city of maquila, a municipality open to foreign and national investment, a real free zone for export.

The year following the inauguration of Zip Choloma, the Honduran Association of Maquiladoras was born as a private, apolitical institution with its own legal personality, with the purpose of encouraging the development of maquila companies, exports and serving their members by representing them before Public and private institutions, nationally and internationally.

For 1998, it appears in the Official Gazette La Gaceta, a decree of law that extends the benefits of the «free zones» to all the national territory.

History of the maquila phenomenon

The world was changing since the 1960s, the positive results obtained in countries such as the Middle East, Korea, Singapore, Taiwan and Hong Kong, prompted several nations in Latin America to issue laws to promote investment, organizing a real competition To attract foreign investors, offering them facilities and great benefits.

The world was changing since the 1960s, the positive results obtained in countries such as the Middle East, Korea, Singapore, Taiwan and Hong Kong, prompted several nations in Latin America to issue laws to promote investment, organizing a real competition To attract foreign investors, offering them facilities and great benefits.

At present, maquila is an expanding industry, the four cardinal points of the country can be seen, it has spread all over the Sula Valley, the central zone, the south and the west, generating thousands of direct jobs whose wages More than half a million people benefit, not counting other jobs indirectly generated by the maquila, such as transportation, food, housing and recreation.

Almost twenty years after the inauguration of Zip Choloma, the term maquila not only includes textiles, it encompasses countless goods ranging from computers to car harnesses, labels, dyes, adhesive tapes; Means employment, prosperity and the hope of a whole people to get ahead.

The story that began with the enactment of a Honduran state law decree, continues to be written in a brilliant way, this boat is far to reach port, so that only remains to work, work and work, as has hitherto been done, For this story to have a happy ending.

Constitutive Law of the Free Zone

The Free zones are areas of the national territory, completely fenced, under fiscal surveillance and without resident population, with jurisdictional character of extra territoriality, according to the Customs Law in its Chapter # 8, Article 110. The Administration, authorization and controlis in charge Of the National Port Company. The introduction of goods is exempt from the payment of customs duties, charges, surcharges, consular fees, internal taxes, consumption and other taxes and charges related to customs operations of import and export. The sales and productions that take place within the Free Zone and the properties and establishments thereof, are exempt from the payment of taxes and municipal taxes.

The Free zones are areas of the national territory, completely fenced, under fiscal surveillance and without resident population, with jurisdictional character of extra territoriality, according to the Customs Law in its Chapter # 8, Article 110. The Administration, authorization and controlis in charge Of the National Port Company. The introduction of goods is exempt from the payment of customs duties, charges, surcharges, consular fees, internal taxes, consumption and other taxes and charges related to customs operations of import and export. The sales and productions that take place within the Free Zone and the properties and establishments thereof, are exempt from the payment of taxes and municipal taxes.